The term “risk technologies” is used more frequently in the current digital era, and with good reason. Businesses seek to understand how technology aids in risk identification, measurement, and management when they question, “What are riskTech?” There is frequently misunderstanding regarding whether it refers to the field of riskTech,” the plural of “riskTech,” or even the industry phrase “RiskTech.” This article will help you understand that, as well as explain the origins of the notion, how it is used in everyday writing, and which term and spelling to use. This guide will help you grasp the main idea and confidently select the appropriate word, whether you’re producing a report for a financial services company, a blog post on machine-learning risk, or you just want clarity.

Risk Technologies: Empowering Resilience in a Complex World

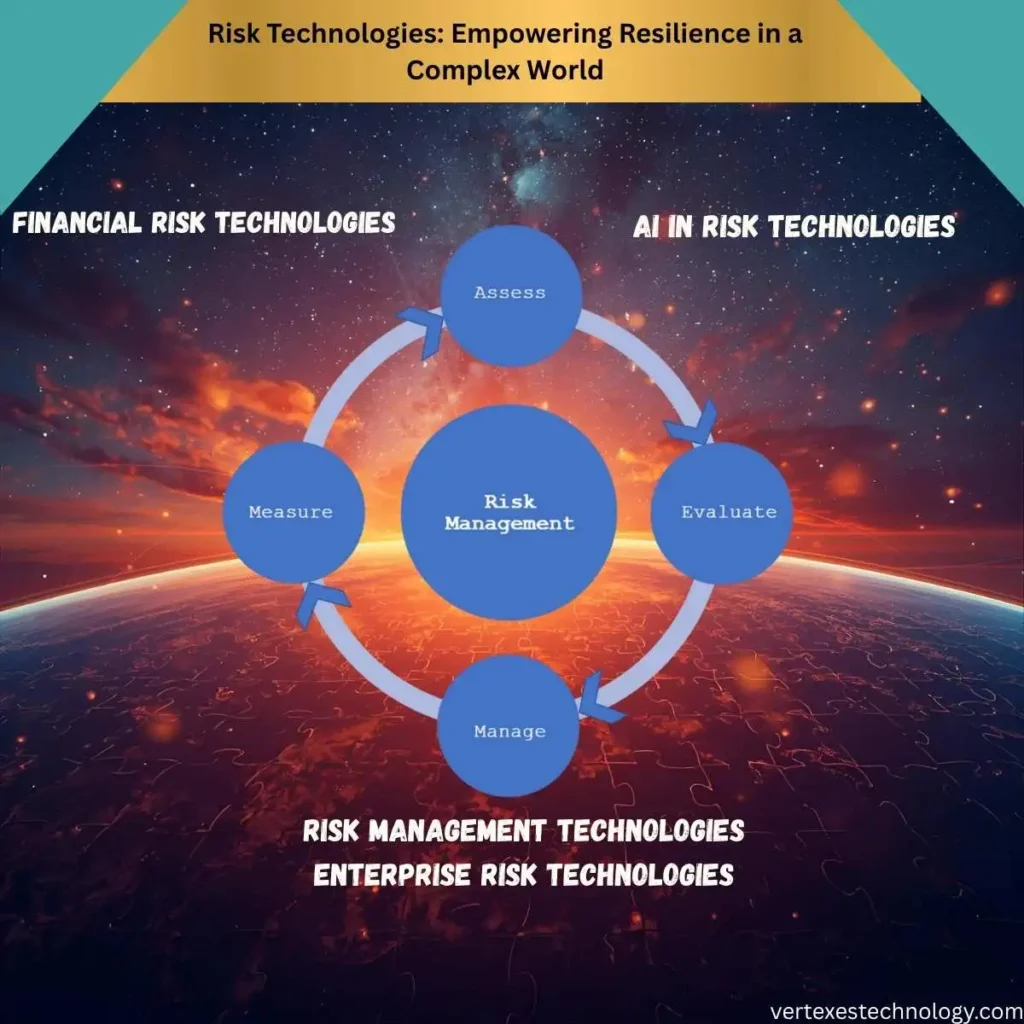

Organisations face a wide range of challenges in a world that is becoming more unstable, from supply chain interruptions and cyberattacks to environmental risks and regulatory changes. Traditional risk management techniques are no longer adequate when these hazards change. Risk technologies are useful in this situation. These cutting-edge tools and frameworks enable companies to more accurately and quickly anticipate, evaluate, and reduce risks.

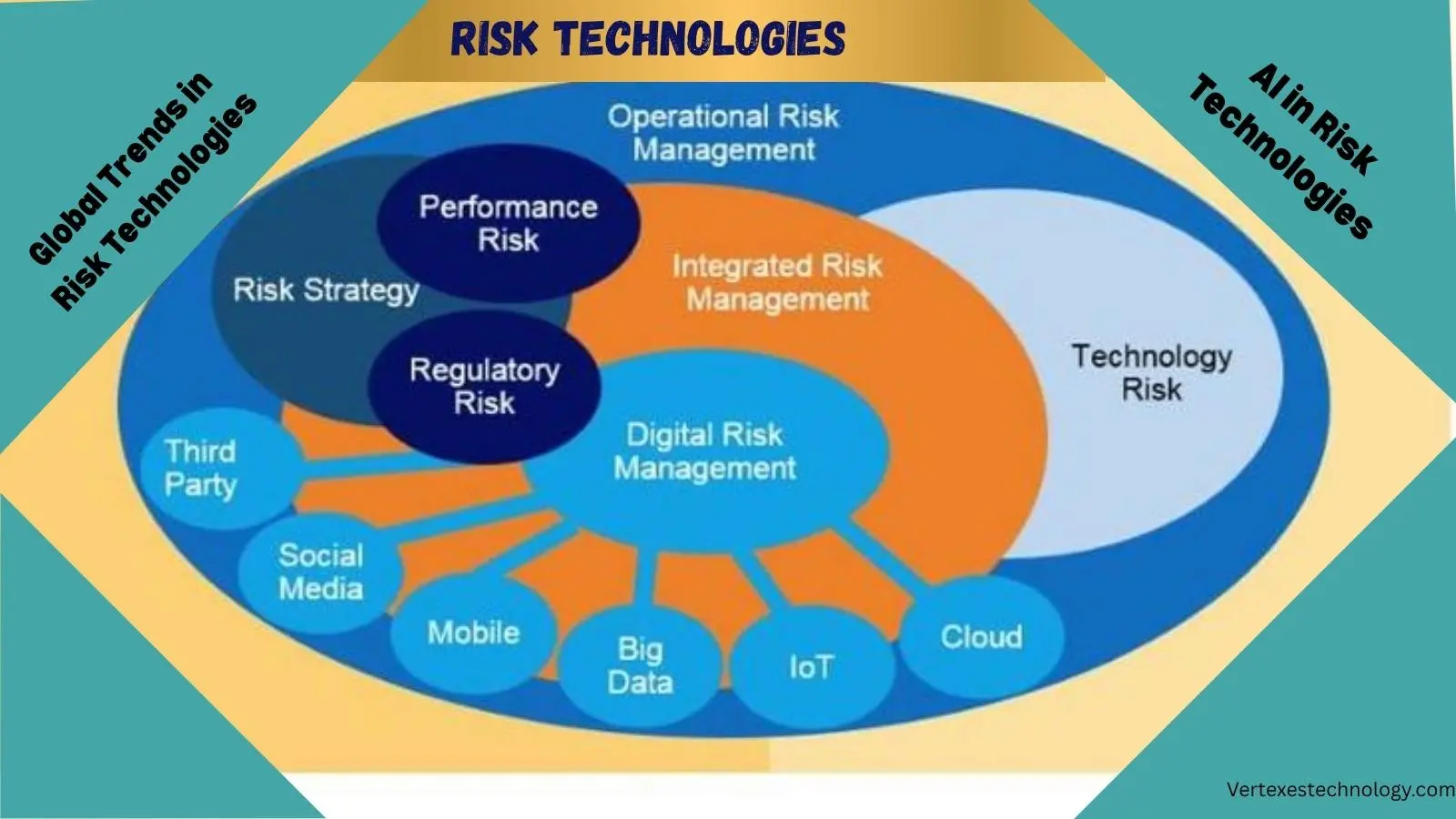

🔍 What Are Risk Technologies?

Digital platforms, systems, and techniques intended to detect, track, and control different forms of organisational risk are referred to as riskTech. These technologies, in contrast to conventional risk assessments, use automation, artificial intelligence (AI), and data analytics to provide real-time insights and predictive capabilities. As a result, they facilitate more resilient operations and quicker decision-making.

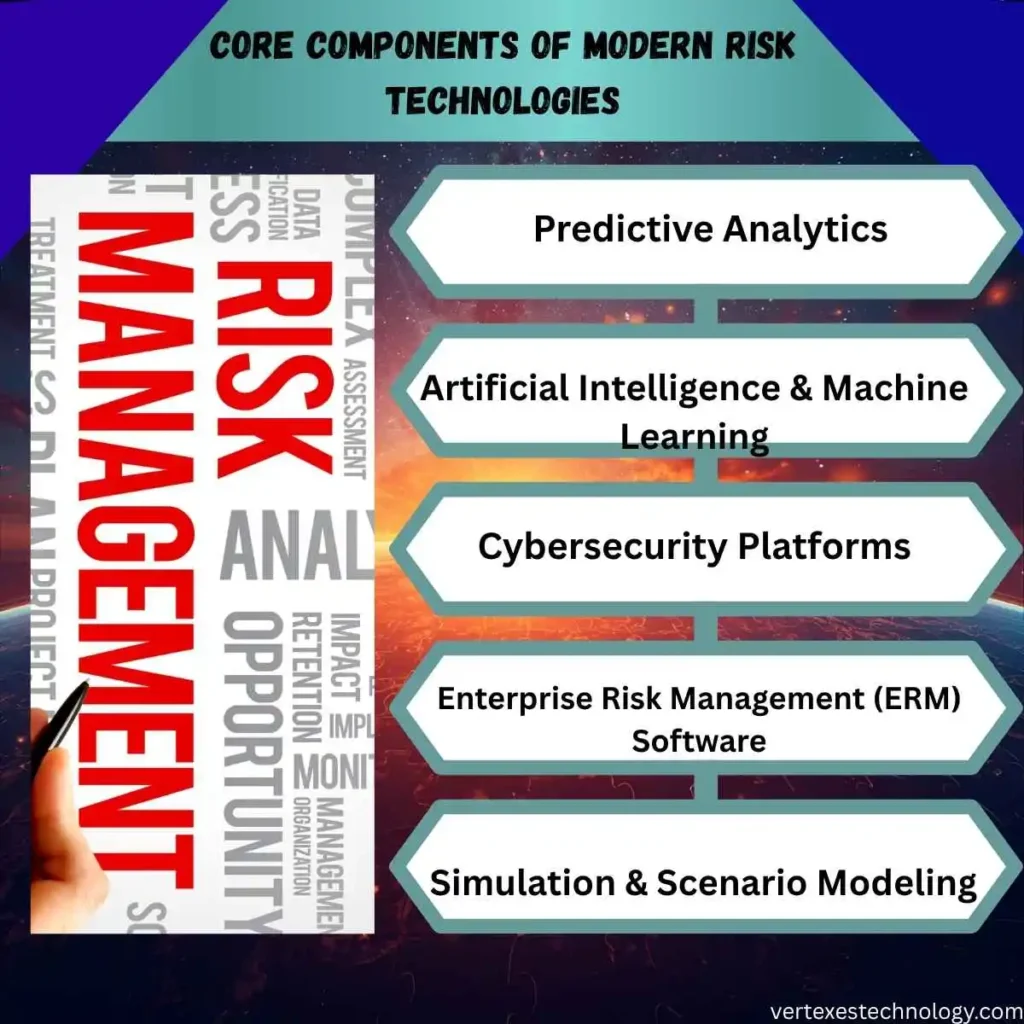

🧠 Core Components of Modern Risk Technologies

Here are the key pillars that define today’s most effective risk technology solutions:

1. 📊 Predictive Analytics

By analyzing historical and real-time data, predictive models forecast potential risks before they materialize. For example, financial institutions use these tools to detect fraud patterns and credit defaults.

2. 🧠 Artificial Intelligence & Machine Learning

AI algorithms can identify anomalies, automate risk scoring, and adapt to emerging threats. Moreover, machine learning continuously improves accuracy by learning from new data inputs.

3. 🔐 Cybersecurity Platforms

With cyber threats on the rise, integrated security solutions monitor networks, detect breaches, and automate incident responses. As a result, organizations can reduce downtime and protect sensitive data.

4. 🌐 Enterprise Risk Management (ERM) Software

ERM platforms centralize risk data, streamline compliance, and align risk strategies with business objectives. In many cases, they also support regulatory reporting and audit readiness.

5. 🧪 Simulation & Scenario Modeling

Tools like Monte Carlo simulations and digital twins allow companies to test risk scenarios and prepare contingency plans. This proactive approach enhances crisis preparedness and resource allocation.

Benefits of Implementing Risk Technologies

| Feature | Benefit |

|---|---|

| Real-Time Monitoring | Enables immediate detection and response to threats |

| Data-Driven Decision-Making | Improves accuracy and reduces human error |

| Regulatory Compliance | Simplifies audits and ensures adherence to industry standards |

| Operational Resilience | Enhances business continuity and disaster recovery |

| Cost Efficiency | Minimizes losses and optimizes risk-related investments |

Risk Technologies – Quick Answer

“riskTech” refers to technological tools, platforms or systems that organisations use to identify, assess, monitor and mitigate various types of risk.

For example:

- A financial services firm using machine-learning software to detect fraud risk.

- An enterprise using cloud-based dashboards to track operational risk exposures.

- A regulator leveraging analytics to monitor systemic risk across multiple firms.

In broader usage, the term may overlap with “RiskTech” (short for Risk Technology) especially within fintech or regulatory-tech contexts.

The Origin of Risk Technologies

The concept of using digital tools for risk management gained traction as organisations became more reliant on complex IT systems and data flows. Initially, risk management focused on human, process or financial risk. Over time, as IT systems proliferated, the “technology risk” and “IT risk” fields emerged.

The phrasing “riskTech” shows up more recently—combining “risk” (the possibility of loss or adverse event) and “technologies” (tools/systems). The spelling difference “technologies” plural emphasises multiple tools or systems rather than a single technology. Some industries shorten it to “RiskTech” (one word, capitalised) which underscores it as a discipline.

Spelling differences such as hyphens (“riskTech”), capitals (“RiskTechnologies”), or singular vs plural (“risk technology” vs “risk technologies”) arise from evolving usage, industry jargon and marketing-language variation.

British English vs American English Spelling

When it comes to the term “risk technologies” there aren’t major spelling differences between British English and American English in terms of core words — both use “risk” and “technologies”. However, there are stylistic differences and variant forms.

| Variant / Spelling | Region | Notes |

|---|---|---|

| risk technologies | US & UK | Standard plural form, neutral. |

| risk technology | US & UK | Singular; emphasises one system or discipline rather than multiple tools. |

| RiskTech | US (often fintech) | Compound shading: capitalised, jargon form. |

| risk-technologies | UK (occasionally) | Hyphenated style, emphasises the technologies part. |

| risk technologies systems | Rare | Redundant; avoid. |

Thus, both British and American English will typically use “risk technologies” without any required spelling change. The key is consistency and clarity.

Which Spelling Should You Use?

- If you’re writing for a US audience, go with “risk technologies” (plural, lower-case) or adopt “RiskTech” if the context is fintech and brand-style is acceptable.

- If you’re writing for a UK/Commonwealth audience, using “risk technologies” is perfectly fine; you might encounter occasional hyphenation but it’s not required.

- If you’re addressing a global or cross-border audience, stick with the neutral “risk technologies”, and introduce any variant (“RiskTech”) once and define it.

- In formal writing (reports, white-papers), avoid over-marketing spellings — prefer the descriptive “risk technologies” rather than trendy capitals.

Common Mistakes with Risk Technologies

- Using singular when plural is appropriate: Writing “risk technology” when you mean the suite of tools. Correction: say “risk technologies” to cover multiple systems.

- Mixing plural and singular inconsistently: Switching between “risk technologies” and “risk technology” in the same document may confuse the reader.

- Capitalising inconsistently: Using “Risk Technologies” in one place, and “risk technologies” in the next.

- Hyphenating unnecessarily: “risk-technologies” may appear odd and isn’t standard.

- Failing to define the term: Especially in non-fintech contexts, readers may not know what “risk technologies” means—so provide a short definition when first used.

Risk Technologies in Everyday Examples

Here are how you might see “riskTech” used in different writing styles:

- Email (informal): “We’re looking at new riskTech to help our team spot market exposures sooner.”

- News headline: “Fintech startup raises $50m to develop riskTech for banks.”

- Social media post: “Exploring cutting-edge #RiskTechnologies in our latest blog — from AI to real-time dashboards.”

- Formal report: “This section reviews our current riskTech, including vendor-provided platforms, in-house dashboards and AI-based predictive models.”

- Technical document: “The deployment of riskTech supports the firm’s enterprise risk management (ERM) framework by enabling improved measurement of credit, operational and cyber risk.”

Risk Technologies – Google Trends & Usage Data

While specific “risk technologies” search data isn’t always public, we can infer interest via related terms like “RiskTech”, “risk management technology”, or “technology risk”. For example, the concept of technology risk continues to grow thanks to digital transformation and increased regulatory scrutiny.

Countries with high financial services sectors (US, UK, Singapore) often show greater interest in rriskTech. Moreover, as fintech and RegTech sectors expand, usage of “RiskTech” in specialised communities is rising. For precise trend numbers one could use tools like Google Trends and filter for “riskTech” + “RiskTech”.

Comparison Table: Keyword Variations Side by Side

| Variation | Meaning | Typical Use Case |

|---|---|---|

| risk technologies | General plural term, many tools/systems | White papers, business articles |

| risk technology | Singular term, one system or discipline | Academic papers, specific solution focus |

| RiskTech | Jargon/brand term | Fintech, startup marketing, sector conferences |

| technology risk / tech risk | The risk itself, not the tools | Risk management literature, frameworks |

| risk-technologies (hyphenated) | Same as plural, but styled | Sometimes UK copywriting, but less common |

FAQs

Q1: What are risk technologies exactly?

A: They’re technological tools and platforms an organisation uses to identify, measure and manage risks. This ranges from dashboards and analytics to machine-learning models.

Q2: Is “RiskTech” the same as “riskTech”?

A: Essentially yes—but RiskTech is more a shorthand or brand term, often used in fintech and regulatory-tech circles. “Risk technologies” is more descriptive and plain-English.

Q3: Can you use both “riskTech” and “risk technologies” interchangeably?

A: Although related, they imply slightly different scopes. “Risk technology” suggests a single system or approach; “riskTech” suggests multiple tools. Choose based on context and clarify.

Q4: Which term is more professional in a report?

A: ““risk management in technology” (plural) is a safe choice for professional reports because it avoids jargon and suggests breadth.

Q5: Are there spelling differences between UK and US for this term?

A: No major spelling differences exist for “risk technologies”. The words themselves are the same. The variation is mainly in style (hyphenation, capitals) rather than spelling.

Q6: What common mistakes should I avoid when using the term?

A: Avoid mixing singular/plural inconsistently, over-capitalising without reason, failing to define the term, or hyphenating unnecessarily.

Q7: Where do I place the term in a sentence?

A: Use it naturally: e.g., “Our team is evaluating new “risk management in technology to improve monitoring of cyber-exposure.” Keep it lower-case unless you’re using it as a defined term or brand.

Conclusion

To sum up: “risk technologies” is a clear, professional term that covers the many tools, systems and platforms used to manage organisational risk. If you’re writing for an international audience, stick with the plural form, define it on first use, and keep your style consistent. Use “RiskTech” only if you’re writing in a fintech or startup context where the term is understood and you’ve explained it. Avoid singular-plural confusion, unnecessary hyphens, and inconsistent capitalisation. By doing so, you’ll meet reader intent: giving a quick answer, offering detailed explanation, and providing professional guidance. Whether you’re drafting a white-paper, blog post, or internal memo, you’ll be equipped to use “riskTech” with clarity and confidence.