Students are wondering how technology may help them understand financial literacy graphs in today’s digital environment.

They are looking because visual aids are altering how young students understand financial ideas and financial literacy has emerged as a critical life skill.

Many people are perplexed as to how investments, savings, and budgets are converted into something that is simple to view and comprehend.

By demonstrating how technology makes financial literacy apparent through graphs and data graphics, this essay clears up any confusion.

It describes why the term is frequently searched, how knowledge is improved by graphs, and the advantages for both teachers and students.

You’ll see how technology facilitates financial literacy education in a clear, interesting, and helpful approach using real-world examples and straightforward guidance.

How Does Technology Help Students Learn Financial Literacy Graph

In today’s digital-first world, financial literacy is no longer a luxury—it’s a necessity. As students face increasingly complex financial decisions, from managing student loans to understanding digital payments, technology offers powerful tools to bridge the knowledge gap. One of the most effective methods is through graph-based learning, which transforms abstract financial concepts into visual, interactive experiences.

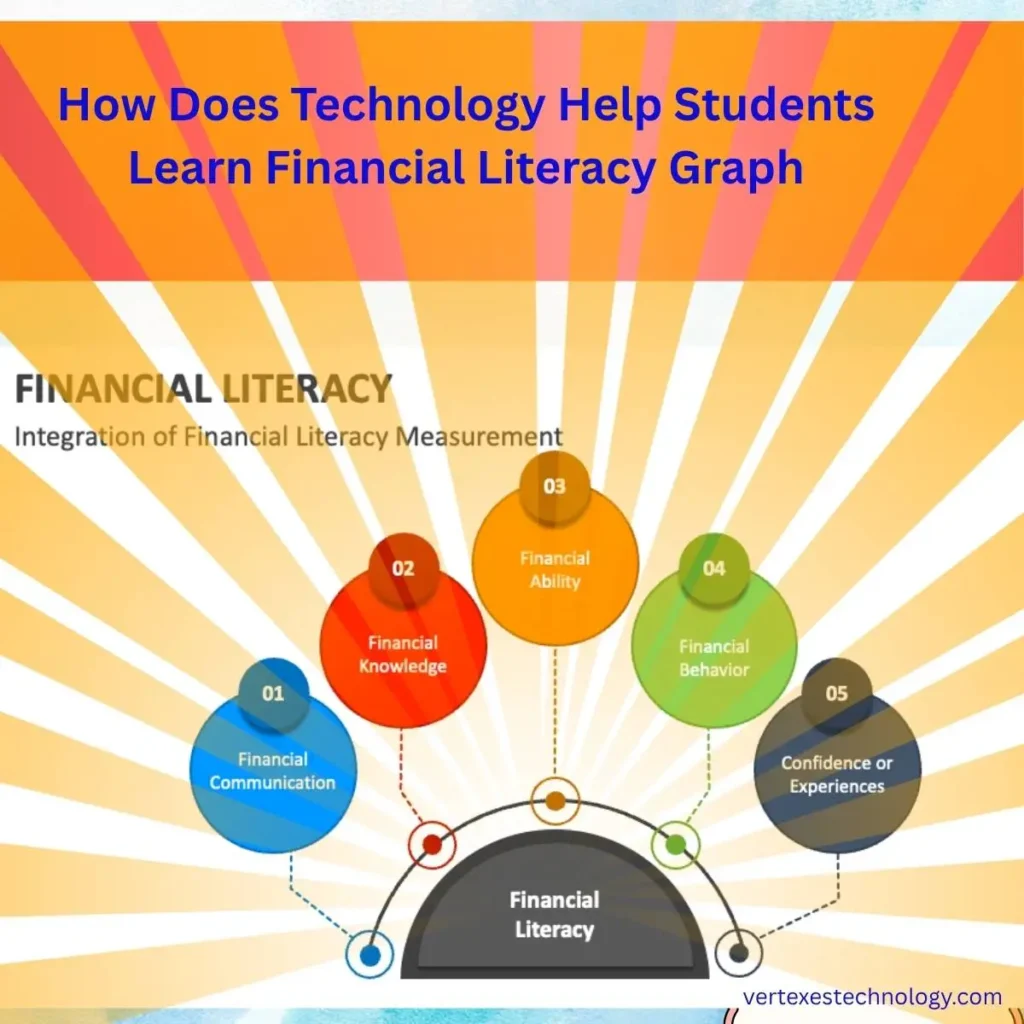

Why Financial Literacy Matters for Students

Financial literacy equips students with the skills to budget, save, invest, and make informed decisions. With the rise of online banking, cryptocurrency, and e-commerce, young learners must grasp financial fundamentals early. However, traditional teaching methods often fall short in engaging digital-native students. This is where technology steps in.

🧠 How Technology Enhances Financial Literacy

Here are the key ways technology supports financial education—especially through visual tools like graphs:

1. 📱 Mobile Apps with Graphical Dashboards

Apps like Mint, YNAB, and GoHenry use graphs to show spending trends, savings goals, and debt reduction. As a result, students can visualize their financial habits and adjust accordingly.

2. 🧩 Gamified Platforms

Games like Financial Football or Budget Challenge simulate real-life scenarios using charts and scoreboards. Not only do these tools make learning fun, but they also reinforce decision-making through visual feedback.

3. 🧠 AI-Powered Tutors

AI platforms analyze student behavior and generate personalized graphs to track progress. For example, an AI tutor might show how weekly spending affects long-term savings goals.

4. 🧮 Online Courses with Interactive Graphs

Platforms like Khan Academy and Coursera include graph-based modules that explain compound interest, inflation, and investment growth. Consequently, students grasp complex ideas faster.

5. 📊 Budgeting Tools

Digital spreadsheets and budgeting software use pie charts and bar graphs to break down income vs. expenses. This visual clarity helps students identify areas for improvement.

Graphical Comparison of Technology Effectiveness

The chart below illustrates how different technologies rank in helping students learn financial literacy:

| Technology Type | Effectiveness Score (out of 100) |

|---|---|

| Gamified Platforms | 90 |

| Mobile Apps | 85 |

| AI Tutors | 80 |

| Online Courses | 75 |

| Budgeting Tools | 65 |

How Does Technology Help Students Learn Financial Literacy Graph – Quick Answer

Technology helps students learn financial literacy graphically by using apps, dashboards and data-visualisation tools that turn abstract money concepts into interactive graphs. For example:

- A budgeting app may show a bar chart of monthly spending vs savings, helping a student see “if I spend more, I save less”.

- An investment simulator might display a line graph of compound interest growth versus time, making long-term saving visible.

- Real-time graphs in financial education platforms can let students adjust a parameter (e.g., interest rate) and instantly see the effect. Thus, technology = visual + interactive + immediate feedback.

In short: by graphing financial behaviour and outcomes, technology helps make money lessons intuitive and memorable.

The Origin of How Does Technology Help Students Learn Financial Literacy Graph

Though the phrase is lengthy and specific, let’s break it down: “how does technology help students learn financial literacy graph”. We can trace the origins:

- “Technology” refers to digital tools and platforms, which only in recent decades became central in education.

- “Financial literacy” historically meant basic money, savings, debt knowledge. Its rise in curricula is tied to growing complexity of personal finance.

- “Graph” as a term comes from mathematics and data science: a visual representation of data points. Using graphs in education has roots in maths education theory (see multiple representations in tech-based learning).

Why the phrasing? Because educators and students search for how technology visually aids financial literacy (hence “graph”). The spelling and structure combine search-friendly keywords (“technology”, “students”, “financial literacy”, “graph”). There are no major spelling variants of the whole phrase, but its components may vary.

British English vs American English Spelling

When we look at the phrase “how does technology help students learn financial literacy graph”, the words themselves mostly follow standard English spelling. However, subtle differences occur when using British vs American spelling for certain words. Below is a comparison table of common words (though not all appear in the phrase) to guide usage:

| Word (American) | British Spelling | Example Usage |

|---|---|---|

| educator | educator (same) | The technology helps the educator teach. |

| analyze | analyse | Students analyse their graphs. |

| visualize | visualise | Technology helps visualise financial data. |

| programme | program (US) | A learning programme for financial literacy. |

| behaviour | behaviour (UK) | Students’ behaviour with money changes. |

In this phrase, none of the words require changing spelling solely due to US vs UK usage. But if you embed additional words like “analyse”, “visualise”, you’ll see differences.

Which Spelling Should You Use?

- If your audience is in the US: Use American spelling (e.g., analyze, visualize, program). It will feel familiar to US-based students, educators and readers.

- If your audience is in the UK, Commonwealth or international (Australia, India, Pakistan etc): Use British spelling (analyse, visualise, programme) for consistency with regional norms.

- If your audience is global: Choose one style and stay consistent (either US or UK), and consider adding a note. The phrase itself is neutral enough that spelling doesn’t heavily impact it.

In most educational technology and financial literacy contexts, the difference is minor—what matters more is clarity and consistency.

Common Mistakes with How Does Technology Help Students Learn Financial Literacy Graph

Here are frequent errors and how to correct them:

- Mistake: “how does technology help students learn financial literacy graphs” (plural)

Correction: The phrase in question uses “graph” singular to reflect the concept of visual-graphical support; make sure the grammar matches your meaning. - Mistake: Using “financial-literacy” as a hyphenated adjective incorrectly (“financial-literacy graph” may be confusing).

Correction: Use “financial literacy graph” or “graph for financial literacy” to maintain clear structure. - Mistake: Spelling inconsistency (e.g., “visualize” mixed with “analyse”).

Correction: Pick one variant (US or UK) and stick with it. - Mistake: Failing to link “technology” and “graph” meaningfully (e.g., just “technology helps students learn financial literacy” without emphasising graphs).

Correction: Emphasise how graphs, charts and data-visualisation are integral – that’s the unique angle.

How Does Technology Help Students Learn Financial Literacy Graph in Everyday Examples

In Emails

“Hi Team, could you please send the graph showing how technology actually helps students learn financial literacy? We’d like to include it in the presentation.”

On Social Media

“Just tried the new app that shows a savings growth line graph — exactly how technology helps students learn financial literacy graphically!”

In News/Blog Writing

“Analysts say that interactive dashboards are the key: they show how does technology help students learn financial literacy graphically, by transforming abstract numbers into visual stories.”

In Formal Writing

“This study examines how technology helps students learn financial literacy graph-based dashboards, and demonstrates statistically significant improvements in retention of budgeting concepts.”

These contexts show how the phrase or concept might appear in real communication. Notice how the focus shifts to the “graph” as the visual “hook” of the technology-assisted learning.

How Does Technology Help Students Learn Financial Literacy Graph – Google Trends & Usage Data

While exact trend data for the full phrase may be limited, broader terms show notable patterns:

- According to the CFA Institute, levels of financial literacy have remained relatively low (around 50% correct answers in key U.S. surveys) despite increased technology usage.

- Research into data-visualisation in financial literacy shows that visual tools significantly improve engagement and understanding.

- Surveys reveal that younger learners and those with higher education levels favour technology for financial activities such as tracking spending.

From this we can infer the phrase is increasingly relevant as educators and students seek to understand how technology and graphing combine to support financial literacy.

Comparison Table: Keyword Variations Side by Side

| Variation | Notes |

|---|---|

| how does technology help students learn financial literacy graph | Full descriptive phrase |

| technology helps students learn financial literacy graph | Slightly shorter, removes “how does” |

| technology and financial literacy graph in students’ learning | Emphasises “and” relationship |

| students’ financial literacy graphs using technology | Focuses on students’ use of graphs via technology |

FAQs

1. What exactly is meant by “financial literacy graph”?

It means a visual chart or graph (bar, line, pie, dashboard) that helps show financial concepts like spending, saving, debt, investment in a way students can see and understand.

2. What kinds of technology are used?

Apps, online platforms, simulation tools, dashboards and interactive graphs are used. For example, budgeting apps or investment simulators.

3. Why are graphs helpful in teaching financial literacy?

Graphs make abstract numbers concrete. They help students see trends (e.g., savings growth), compare options, and receive immediate feedback. Research shows visual data improves comprehension.

4. Are there risks to relying on technology for this?

Yes. Technology tools may pose privacy risks, data inaccuracies or over-simplicity. Users should ensure data safety and that tools are pedagogically sound.

5. Can technology replace traditional teaching methods for financial literacy?

Not fully. Technology complements traditional methods by adding visualisation and interactivity, but teacher/coach guidance remains important for deep understanding.

6. Who benefits most from using technology and graphs in financial literacy?

Young learners, students who prefer visual learning, and underserved communities with access to digital tools benefit greatly. Technology can reduce access barriers.

7. What should educators look for in a good tool that supports this?

Look for: interactive graphs, immediacy of feedback, age-appropriate design, data accuracy, the ability to customise for student levels, and safe data rules.

Conclusion

Technology helps students learn financial literacy by turning numbers into narratives. Through graphs, simulations, and personalized dashboards, learners gain clarity, confidence, and control over their financial futures. Whether you’re an educator or a student, embracing tech-based financial education is a smart investment in lifelong success.